Digitt+ is an Electronic Money Institution (EMI) regulated by the State Bank of Pakistan. We offer a range of digital financial services designed to make your money more convenient and accessible.

Simply go to Google Play Store and search for Digitt+, or you can click on the given link to download :

For Android users: https://play.google.com/store/apps/details?id=com.aft.digitt&hl=en

You can open Digitt+ accounts without needing a mobile number registered on your own CNIC. However, for enhanced transactional limits (Rs.1,000,000/month), a mobile number registered on your own CNIC is required.

No, you cannot register for a Digitt+ account with an expired CNIC, as a valid CNIC is required for verification purposes. It is recommended to renew your CNIC before registering.

No, Digitt+ can only be used in Pakistan.

You must use your own mobile number to receive the OTP (One-Time Password). Without it, you won’t be able to access your account. It is, therefore, recommended to set up or access your Digitt+ account using the mobile number you are actively using.

No, you can only open one Digitt+ account on one CNIC.

Digitt+ provides a wide range of financial services, they including;

- Funds Transfer (Send money to anyone, anywhere in Pakistan).

- Bill Payment (More than 2000 service providers; all utility bills, Credit Card, Education Fees, Government Payments etc).

- Mobile Top-up (Prepaid, Postpaid, Bundles).

Any Pakistani citizen of age 18 and above can register for Digitt+ wallet.

If you are a farmer or have any connection to agriculture or farming, you can register for a farmer account and gain access to:

- Convenient crop payments

- Access to agri supplies

- Expert opinion and crop analytics

- Crop insurance

Any user other than a farmer who wants to open an account for everyday transactions, can register for an Individual account and access:

- Convenient day-to-day transactions

- Bill payments and mobile loads

- Bookings; travel, cinema, events, hotels

- Personalized transactions and services

You need a valid CNIC/ NICOP and mobile number for opening a Digitt+ account.

Currently, Digitt+ is only accessible through Android mobile app.

Yes, all your information is encrypted and stored on our secure servers and data centers, which are not accessible to the public. Our servers are protected by firewalls and comply with all relevant security standards.

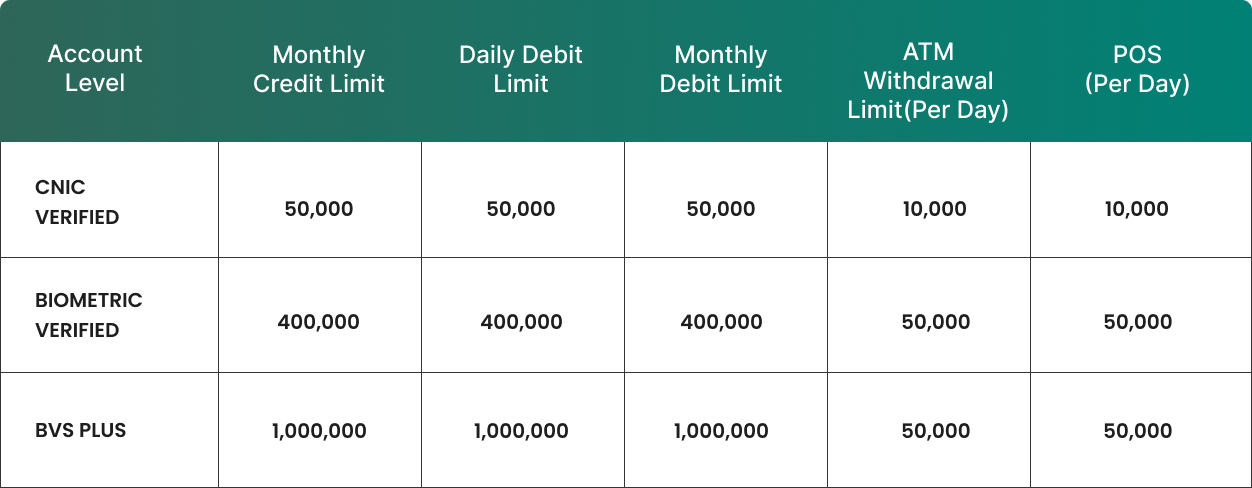

You can upgrade your wallet limits from ‘Account Settings’ in the side menu of your Digitt+ app.

Currently, Digitt+ is only accessible through the Android mobile app.

There is no fee for downloading or registering on Digitt+.

- Digitt+ to Digitt+ account transfer is free of charges

- IBFT upto Rs. 25,000/month is Free.

Any fees associated with transactions are outlined in the Schedule of Charges.

No, there is no requirement to maintain a minimum balance in your Digitt+ wallet. You can use it freely for your financial needs, as per your convenience.

This means your account is currently under verification based on the details you provided during registration. Account approval may take up to 1-2 working days. You shall receive a notification or SMS once your account is approved.

If you encounter any issue or delay, you can contact Digitt+ customer support for assistance.

Your Digitt+ wallet PIN is a 5-digit code used for logging into the app and for completing transactions. For security reasons, it is strongly recommended that you do not share your PIN with anyone.

If you’ve forgotten your Digitt+ wallet PIN, you can reset it by following these steps:

- Open the Digitt+ app and go to the login screen.

- Select the “Forgot PIN” option.

- Follow the prompts to verify your identity, which may include answering security questions or receiving a verification code via SMS or email.

- Once your identity is verified, you’ll be able to set a new PIN.

If you encounter any issues during the process, you can contact Digitt+ customer support for assistance.

Yes, once your Digitt+ account is approved, you may choose to enable fingerprint or face ID (Biometrics) to login to Digitt+ app. You always have the option to switch back to logging in via your PIN by disabling biometric login option.

You can reach the Digitt+ helpline at 042-111-344-488.

You can email us your complaints at [email protected].

You can easily send money from your Digitt+ to another Digitt+ account or to any other bank account using your Digitt+ account.

Sending money from one Digitt+ account to another is completely free of charges.

Sending money to any other bank account is free of charge if the amount is within Rs. 25,000. For transactions above that amount, charges will apply as per the Schedule of Charges.

- Login to your app

- Tap on ‘Send Money’

- Select ‘Digitt+’ transfer type

- Enter account number

- Enter amount

- Verify details and transfer

- Login to your app

- Tap on ‘Send Money’

- Select ‘Bank Transfer’

- Enter account number

- Enter amount

- Verify details and transfer

Yes, you can send money from other banking apps to your Digitt+ account. Simply use the transfer option in your banking app, select Digitt+ from the bank list, and enter your Digitt+ account number to complete the transfer.

You can add cash to your Digitt+ account through following ways:

- Add cash with bank transfer

- Cash Deposit Machine (CDM)

Digitt+ does not charge its customers for any incoming transfers. However, the sender may be charged by their bank.

You can pay for electricity, gas, telephone, internet, water, and various other bills (2000+ service providers) through Digitt+ app.

- Login to your app

- Tap on ‘Payment’

- Select the bill that you want to pay

- Choose bill company from the dropdown menu

- Enter Consumer/ Reference number

- Verify bill details and pay

You might be unable to pay utility bills from your Digitt+ app due to following reasons:

- Incorrect Consumer/ Reference number

- Solution: Enter correct Consumer/Reference number

- Insufficient account balance

- Solution: Add cash to your account.

- You have consumed your transactional limits

- Solution: Upgrade your account level

Paying bills from Digitt+ app is free of any charges.

Digitt+ does not charge any fees for sending mobile load through your Digitt+ account. However, your mobile service provider may apply charges/taxes for the mobile load transaction.

Digitt+ does not charge any fees for sending mobile load through your Digitt+ account. However, your mobile service provider may apply charges/taxes for the mobile load transaction.

You can edit the payment details before the transaction is submitted. The transaction cannot be reverted once it is completed. You are requested to recheck the transaction at ‘Review Details’ screen before the request is processed.

Yes, you can easily pay your postpaid bill using your Digitt+ account. Simply select ‘Postpaid’ from the ‘Mobile Loads & Packages’ option and enter your postpaid number to complete the payment.

- Login to your App

- Tap on ‘Mobile Loads & Packages’

- Select ‘Make your own Package’

- Enter the required minutes, messages & data along with the validity

- Digitt+ will recommend the available bundles according to the desired needs.

The self-service feature allows you to view and manage the self-service features available by all major telcos.

Ordering your Digitt+ debit card is quick and easy. Follow these steps:

- Access the Cards Section: Open your Digitt+ wallet and navigate to the cards section from the footer.

- Agree to Terms: Accept the terms and conditions.

- Provide Your Address: Enter the delivery address for your card.

- Choose Your Card: Select the desired card scheme.

- Review and Confirm: Double-check your details.

- Pay the Fee: Complete the payment for the card fee.

- Submit Your Order: click the “Order Card” button. Congratulations! You’ve successfully placed your order. You’ll receive a tracking number on the screen, which you can use to monitor the delivery status of your card. Your card should arrive within 3-5 business days.

To activate your Digitt+ debit card, follow these simple steps:

- Navigate to Activation: Go to the card section from the footer of the dashboard and click “Activate Card.”

- Enter Card Details: Provide your 16-digit card number and expiry date on the new screen.

- Verify with OTP: An OTP will be sent to you for verification; enter it to proceed.

- Set Your PIN: Create a 4-digit PIN for your card. Remember, this PIN should be kept secure and not shared with anyone. Your card will be activated once the PIN is set.

If your card is lost or stolen:

- Freeze Your Card: Immediately freeze your card through the app to prevent unauthorized use.

- Contact Support: Call our helpline at 042-111-344-488 to permanently block the card and request a replacement.

To change your ATM PIN, follow these steps:

- Access Card Controls: Navigate to “My Card” in the Digitt+ mobile app.

- Change PIN: Select “Card Controls” from the dashboard, then click “Change PIN.” Enter your old PIN, followed by the new one. Once validated, your PIN will be updated.

To request a card replacement, please call the Digitt+ helpline at 042-111-344-488.

Yes, your Digitt+ Mastercard debit card can be used for local and international online transactions wherever Mastercard is accepted.

Yes, you can withdraw cash from any ATM across Pakistan with your Digitt+ Mastercard debit card. Note that applicable fees will be charged as per our Schedule of Charges (SOC).

If you’ve misplaced your Digitt+ debit card:

- Freeze the Card: Immediately freeze your card via the app by navigating to Cards > Freeze Card.

- Contact Support: If you don’t have access to the app, call 042-111-344-488 to freeze your card through Customer Service.

- Request a Replacement: If you cannot find your card, block it permanently by contacting our call center and order a replacement.

- Freeze: Use this option if you believe you may have misplaced your card. Freezing temporarily disables the card, limiting transactions. Recurring payments, such as subscriptions, will still be processed. You can unfreeze your card at any time through the app.

- Block: If your card has been lost, compromised, or stolen, block it immediately. Once blocked, the card cannot be unblocked, and you will need to order a new one as a replacement.

PayPak

- Where can I use my PayPak debit card? Your Digitt+ PayPak debit card is accepted at many retail locations and ATMs across Pakistan.

- Can I shop online with my PayPak debit card? Currently, PayPak debit cards are not enabled for online payments. However, you can use your Digitt+ Mastercard Virtual card for online transactions.

- Can I use my PayPak debit card for international payments? No, PayPak cards can only be used for in-store purchases and ATM withdrawals within Pakistan.

When ordering your Digitt+ debit card, you can choose between Mastercard and PayPak. Here’s a comparison to help you decide:

Features | Mastercard | PayPak |

ATM Withdrawal (Local) | ✅ | ✅ |

ATM Withdrawal (International) | ✅ | ❌ |

POS (Local) | ✅ | ✅ |

POS (International) | ✅ | ❌ |

E-commerce Transaction (Local) | ✅ | ❌ |

E-commerce Transaction (International) | ✅ | ❌ |

Issuance Fee | 1000 + tax PKR (One time) | 1000 + tax PKR (per Annum) |

Golootlo Discounts | ❌ | ✅ |

Please note that once you order one of these cards, you cannot switch to the other.

If your card is captured by an ATM:

- Visit the Branch: Go to the specific ATM branch and speak with the manager. The bank typically holds cards for 2 days. Bring your CNIC for identity verification.

- Contact Us: If the bank cannot return your card due to verification issues, call our helpline at 042-111-344-488 and provide the bank’s name. We will reach out to resolve the issue.

- Return of Card: If the ATM-captured cards are sent back to us, we will promptly return them to the respective users.

If you’re having trouble using your card for a physical purchase:

- Check if the Card is Frozen: Unfreeze your card via the app if needed.

- Verify the PIN: Ensure you’re entering the correct PIN. You can reset it from the app under “Card Controls.”

- Check Your Balance: Confirm that you have sufficient funds in your wallet.

If the issue persists, contact us via our helpline or WhatsApp support at 042-111-344-488. Provide the following details:

- The amount of the transaction.

- The location where you tried to use your card.

- Whether you tried to pay by inserting or tapping the card.

- A screenshot of the error message displayed.

If the courier status shows your card was delivered and signed for, but you haven’t received it:

- Check with Family/Neighbours: Confirm if someone accepted it on your behalf.

- Contact Support: If the card was delivered to the wrong address, contact us via WhatsApp or our helpline at 042-111-344-488, and we’ll investigate and resolve the issue.

If your address is outside Our courier service range:

- Provide an Alternate Address: Contact us via WhatsApp or our helpline at 042-111-344-488 with a complete and accurate alternate address where you can receive the card.

You can request the closure and deletion of your account details through any of the following methods:

In-App Support:

Use the in-app customer support to submit your account deletion request.

Call Center:

Contact our support team by dialing 042-111-344-488 and ask our agents to close and delete your account.

Email:

Send an email to [email protected] with a request to close and delete your account.