Development

Services

Welcome to Our

Development Services

We leverage our expertise to offer top-notch development services tailored to meet your business needs, whether you're a startup or an established enterprise. Digitt+ excels in creating mobile and web solutions, along with robust backend systems, transforming them into user-centric platforms that reflect your vision and mission through innovative, sustainable design. Utilizing the latest technologies, our extensive experience across various sectors ensures visually captivating and immersive digital experiences. Partner with us to elevate your digital presence and drive sustainable change through tech-driven innovation

Key HighLights

Man Days Of Experience

Types Of Services Offered

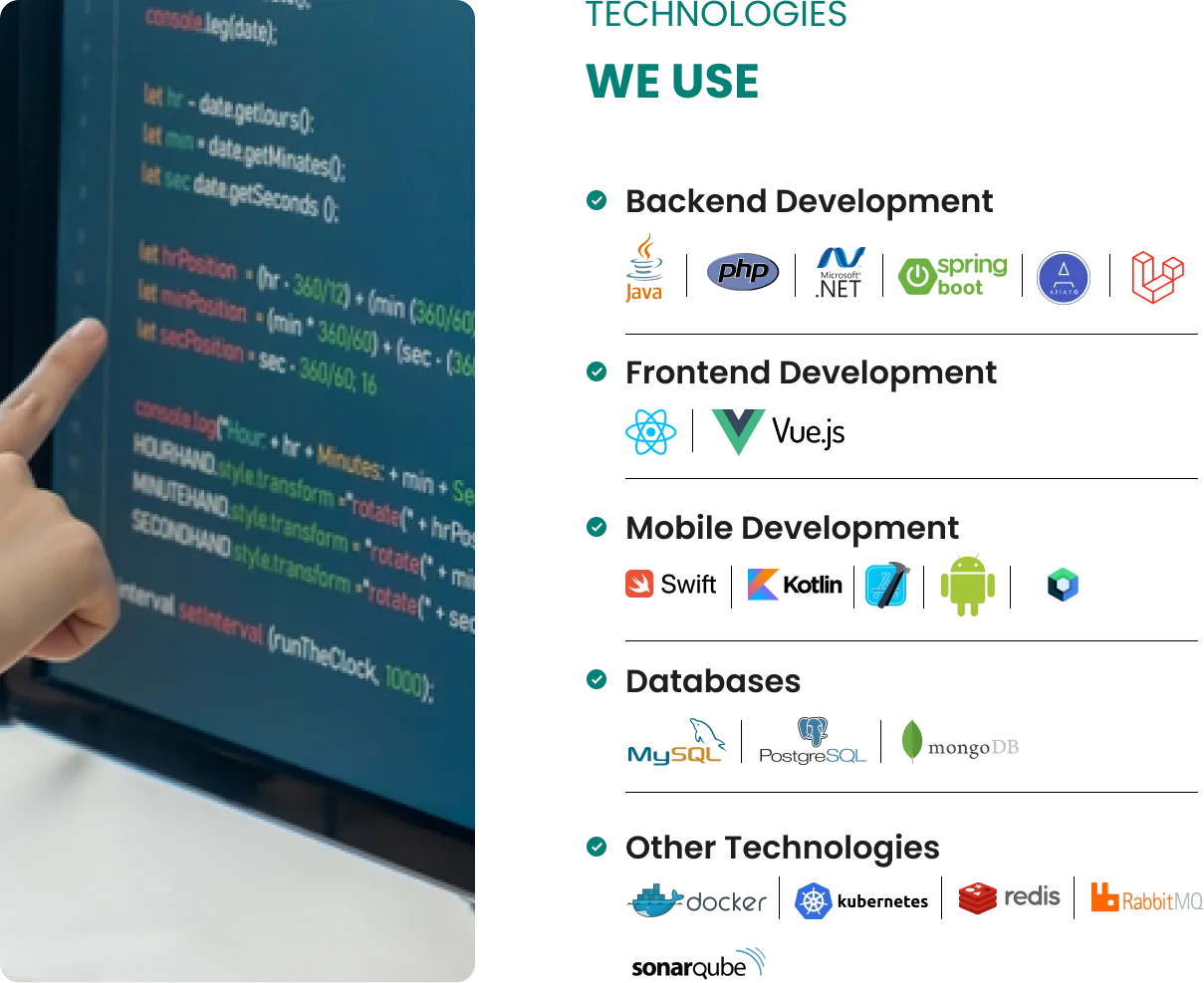

Technologies & Core Areas Of Expertise

Expertise

We Offer

Fintech

☉ Digital Financial Services

☉ Digital Wallets

☉ Digital Payments and Tokenization

☉ Open Banking APIs

☉ High Volume Transaction Processing

☉ QR Payments

☉ (Digital Onboarding – solutions)

☉ Mobile Applications

☉ Payment Schemes and Systems

☉ Micro Insurance and Loans

☉ Unbanked/Underbanked Solutions

☉ Multi-Million Consumer Systems

☉ Integration with Financial Services, Telecom, and Other Industries

☉ Web-Based Services

☉ Payment Switches and Gateways

☉ Agent-Based Banking

☉ Cash Transfer Program

☉ Digital Merchant Onboarding

☉ Compliance with Regulations and Standards

Mobile Application Development

☉ Hybrid: Flutter, React Native, Ionic, Xamarin

☉ Security: Encryption, Obfuscation, Vulnerability Identification

Web Development

☉ Web Applications

☉ Dashboards and Portals

☉ Responsive Web Interfaces

Integration Development

☉ Cross Platform Integrations

☉ Single Point Integration

☉ Open APIs

☉ Integration with Financial Services, Telecom, and Other Industries

☉ Enterprise Service Bus

UI/UX

☉ Mobile and Web User Interface and Experience Development

☉ UI/UX Testing

Bespoke Development

☉ Architecture and API Design

☉ Microservices

☉ Website Development

Quality Assurance and Testing

☉ Functional/UI, Integration, Load/Stress, Data Migration Testing

☉ Test Designing, Regression Testing, Automation

Databases

☉ Architecture Design, Development, and

Performance Tuning

☉ Multi-Vendor Databases, Backup, Restore, Recovery

Information Security

☉ Pen Testing, Security Certification,

Data Design, Public/Private Key

Management

DevOps

☉ Source Code Management, CI/CD Pipeline, Microservices, Cloud Platform – Like AWS Azure

☉ Performance Optimization, High Availability, Environment Monitoring

RegTech

☉ Integration with Regulatory Systems

☉ AML, KYC, PEP, Sanction Lists, AI for Customer Screening

Identity Management and Security

☉ Two Factor Authentication,

PIN Management, Biometric Verification, In App BVS & Liveliness

☉ Integration with National and Proprietary Databases

Reporting and Reconciliation

☉ Reports Management, Settlement Accounts, Automated Reconciliation

Clearing and Settlement

☉ Settlement Files, Online Settlement, Accounting Entries, Manual Adjustments

Project Management

☉ Product Lifecycle Management, Planning, Coordination, Monitoring

☉ Requirement Analysis, Documentation, Risk, Budget, Release, Configuration Management

Customer Relationship Management

☉ Support, Maintenance, CRM Portal, Loyalty Management, Promotions

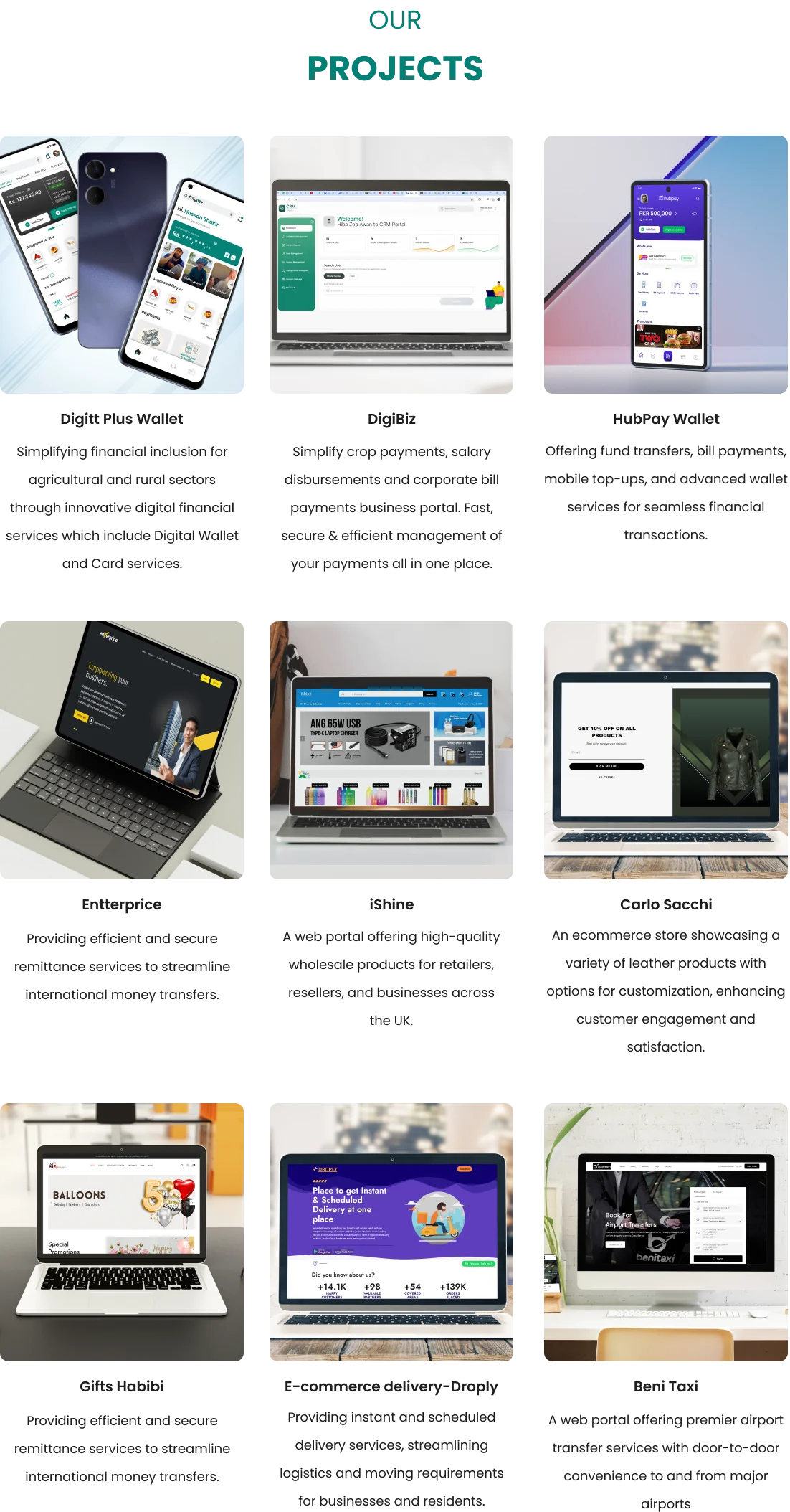

Our

Products

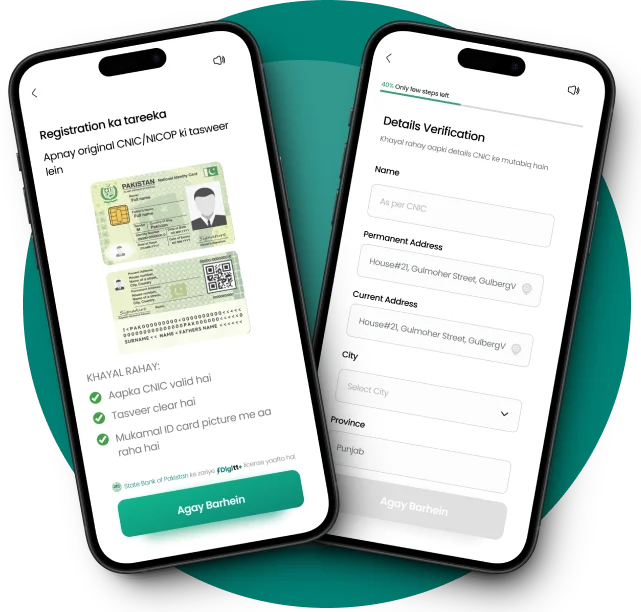

KYC & Digital Onboarding Solution

Explore our comprehensive suite of E-KYC and digital onboarding solutions, customizable for your needs. Implement them end-to-end or embed specific components as required modified to sound more web-friendly

Identity Document Authentication

Facial Comparison

Facial Liveliness

Touchless Biometric

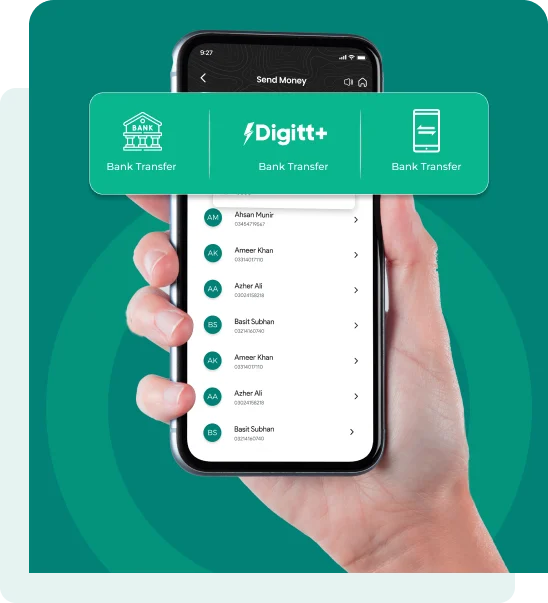

Digital Wallet

Discover AFT’s all-encompassing solution for digital wallet management. Seamlessly integrating cutting-edge technology with unparalleled convenience, it revolutionizes your financial interactions. Explore a comprehensive suite of features designed to elevate your digital wallet experience.

Expanded Payment Options

Customizable Wallet Profiles

Streamlined Account Management

Efficient Manual Transactions

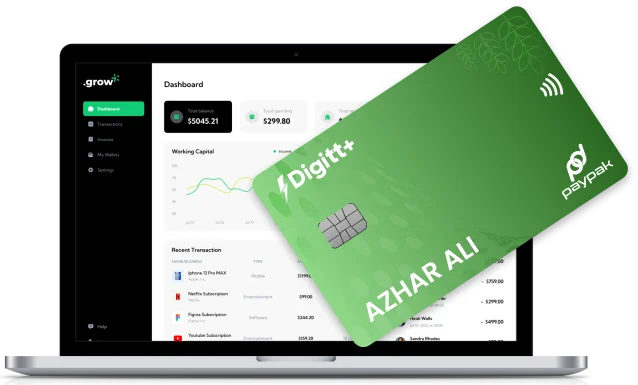

Card Management System

Experience a comprehensive, secure, and intuitive solution revolutionizing card issuance and management for financial institutions. Our CMS is built to meet the latest security standards, ensuring robust protection and compliance with industry regulations.

End to End Card issuance and Management

Comprehensive Card production Life cycle Management

Advance Configuration Capabilities

Data Transliterations Services

Our Data Transliteration Services bridge linguistic gaps, facilitating seamless and accurate data exchange globally. Our sophisticated solutions convert data between scripts while preserving meaning and integrity, enhancing communication and user experience.

Accuracy and Consistency

Realtime Transliteration

Seamless Integration

App Content & Configurations Management System

Experience our Dynamic Content Management System, designed to enhance the flexibility and responsiveness of our fintech mobile app. This system enables real-time updates and management of app content, ensuring users always have access to the latest information and features without requiring app updates

Real time updates

Multi Channel Transaction Routing

Transaction Monitoring System (TMS)

Explore our robust Transaction Monitoring System (TMS), meticulously designed to ensure the security and compliance of financial transactions. Our TMS dynamically triggers rules based on customizable configurations, enabling real-time monitoring and analysis of transaction activities. Detect and prevent fraudulent activities, ensure regulatory compliance, and maintain the integrity of financial operations with our advanced system.

Configurable Rules

Realtime Monitoring

Comprehensive Reporting

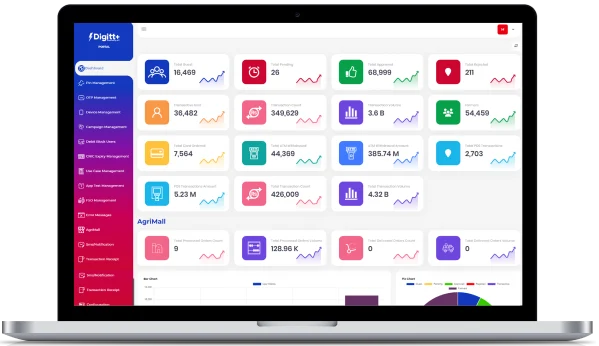

Customer Relationship Management Systems (CRM)

Discover our comprehensive Customer Relationship Management (CRM) system, featuring an end-to-end complaint management solution. Gain a holistic view of customers and their activities, including transaction histories, for effective issue resolution. Enhance customer satisfaction and loyalty with prompt and efficient handling of complaints and inquiries.

Holistic Customer View

End to End Complaint, Service and Feedback Management

Automated Workflows

Enhanced Customer Insights

Flexible Integration Capabilities

Our Proud

Partner

Digitt+ and Covalent Launch “Zariya” — A Groundbreaking Platform for Banking as a Service!

We are thrilled to unveil Zariya, a revolutionary platform designed to redefine market standards with a comprehensive tech stack on a flexible pay-as-you-grow model. This ensures the quickest time to market in the region, providing businesses with the tools they need to succeed.

Identity Document Authentication

Facial Comparison

Facial Liveliness

Touchless Biometric

Zariya offers an impressive suite of services:

☉ White-labelled mobile apps

☉ Seamless funds transfers

…and much more!

☉ Digital onboarding

☉ Generative AI chatbot

☉ Digital wallets & card issuing

☉ Digital cheque signature verification

This innovative platform is set to transform the banking and financial services landscape, enabling businesses to

innovate, scale, and thrive like never before.

Hear more from our

Leadership

OTher Partners