Debit Card

Unlock the power of cashless convenience, global acceptance, and unparalleled security, all at your fingertips. Welcome to a new era of financial freedom with Digitt+ MasterCard–where convenience meets confidence, and possibilities know no bounds!

Debit Card

- PayPak Debit Card

- MasterCard Debit Card

MasterCard Debit Card

- Instant Access:

Tap into your funds instantly, whether you’re shopping online, dining out, or traveling abroad.

- Global Acceptance:

Making it the perfect companion for your adventures.

- Tap N Pay (Contactless):

Enjoy the convenience of swift and secure contactless transactions, keeping your purchases hassle-free.

- 24/7 Security:

Your peace of mind is our priority.

- Dispute Resolution:

Raise disputes quickly and easily through the Digitt+ app—right at your fingertips!

Tailored Features

- E-Commerce Management:

Enable/Disable your card on

E-Commerce Platforms

- Consumer Card Controls: Control when, where & how MC can be used.

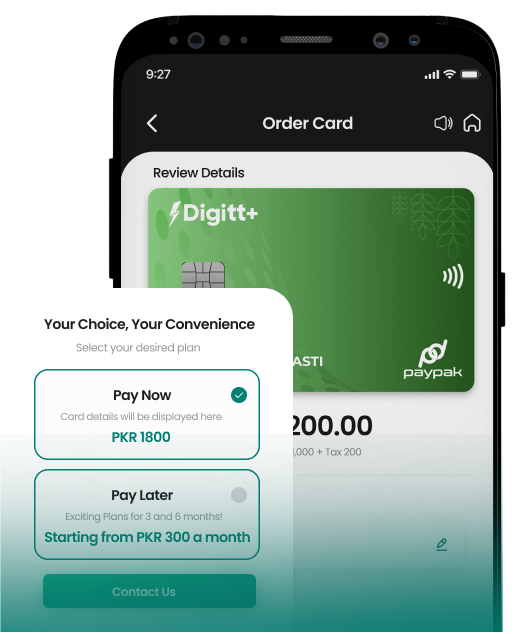

- Card on Installment: Purchase your card on easy monthly installments.

- Budget Card Activation: Set your Budget – Control your spending according to your needs

PayPak Debit Card

- PayPak debit card is the local scheme card powered by 1-Link. This card offers you a basic level and convenient payment solution.”

- Conduct secure transactions locally at any ATM or POS nationwide with lower annual fee”

Key Features

- ATM Cash Withdrawal:

Withdraw cash from any ATM country wide.

- Local Acceptance:

Making it perfect for your day-to-day transactions.

- Tap N Pay (Contactless):

Your peace of mind is our priority.

- Dispute Resolution:

Raise disputes quickly and easily through the Digitt+ app—right at your fingertips!

Debit Card Guidelines

Some useful guidelines to keep in mind regarding your Debit Card usage and for your security & safety

Temporarily block/freeze your card from the Digitt+ App

Keep your ATM PIN secure: Remember it, guard it—never share with anyone including Digitt+ staff, stay secure!

For your security, never share your Debit Card details with anyone, including Digitt+ staff, under any circumstances. This includes requests for limit adjustments, cancellations, or other information.

Avoid outdoor ATMs: ATM at branch, inside the mall, is generally safer than a lone outdoor ATM.

FAQs

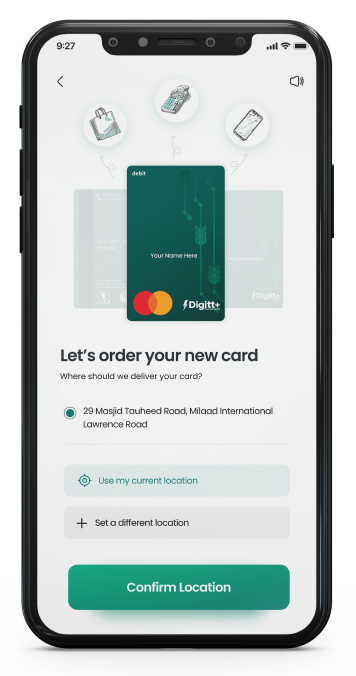

Ordering your Digitt+ debit card is quick and easy. Follow these steps:

- Access the Cards Section: Open your Digitt+ wallet and navigate to the cards section from the footer.

- Agree to Terms: Accept the terms and conditions.

- Provide Your Address: Enter the delivery address for your card.

- Choose Your Card: Select the desired card scheme.

- Review and Confirm: Double-check your details.

- Pay the Fee: Complete the payment for the card fee.

- Submit Your Order: Click the “Order my Mastercard” button. Congratulations! You’ve successfully placed your order. You’ll receive a tracking number on the screen, which you can use to monitor the delivery status of your card. Your card should arrive within 3-5 business days.

To activate your Digitt+ debit card, follow these simple steps:

- Navigate to Activation: Go to the card section from the footer of the dashboard and click “Activate Card.”

- Enter Card Details: Provide your 16-digit card number and expiry date on the new screen.

- Verify with OTP: An OTP will be sent to you for verification; enter it to proceed.

- Set Your PIN: Create a 4-digit PIN for your card. Remember, this PIN should be kept secure and not shared with anyone. Your card will be activated once the PIN is set.

If your card is lost or stolen:

- Freeze Your Card: Immediately freeze your card through the app to prevent unauthorized use.

- Contact Support: Call our helpline at 042-111-344-488 to permanently block the card and request a replacement.

To change your ATM PIN, follow these steps:

- Access Card Controls: Navigate to “My Card” in the Digitt+ mobile app.

- Change PIN: Select “Card Controls” from the dashboard, then click “Change PIN.” Enter your old PIN, followed by the new one. Once validated, your PIN will be updated.

To request a card replacement, please call the Digitt+ helpline at 042-111-344-488

Yes, your Digitt+ Mastercard debit card can be used for local and international online transactions wherever Mastercard is accepted.

Yes, you can withdraw cash from any ATM across Pakistan with your Digitt+ Mastercard debit card. Note that applicable fees will be charged as per our Schedule of Charges (SOC).

If you’ve misplaced your Digitt+ debit card:

- Freeze the Card: Immediately freeze your card via the app by navigating to Cards > Freeze Card.

- Contact Support: If you don’t have access to the app, call 042-111-344-488 to freeze your card through Customer Service.

- Request a Replacement: If you cannot find your card, block it permanently by contacting our call center and order a replacement.

- Freeze: Use this option if you believe you may have misplaced your card. Freezing temporarily disables the card, limiting transactions. Recurring payments, such as subscriptions, will still be processed. You can unfreeze your card at any time through the app.

- Block: If your card has been lost, compromised, or stolen, block it immediately. Once blocked, the card cannot be unblocked, and you will need to order a new one as a replacement.

PayPak

- Where can I use my PayPak debit card? Your Digitt+ PayPak debit card is accepted at many retail locations and ATMs across Pakistan.

- Can I shop online with my PayPak debit card? Currently, PayPak debit cards are not enabled for online payments. However, you can use your Digitt+ Mastercard Virtual card for online transactions.

- Can I use my PayPak debit card for international payments? No, PayPak cards can only be used for in-store purchases and ATM withdrawals within Pakistan.

When ordering your Digitt+ debit card, you can choose between Mastercard and PayPak. Here’s a comparison to help you decide:

Features | Mastercard | PayPak |

ATM Withdrawal (Local) | ✅ | ✅ |

ATM Withdrawal (International) | ✅ | ❌ |

POS (Local) | ✅ | ✅ |

POS (International) | ✅ | ❌ |

E-commerce Transaction (Local) | ✅ | ❌ |

E-commerce Transaction (International) | ✅ | ❌ |

Issuance Fee | 1000 + tax PKR (One time) | 1000 + tax PKR (per Annum) |

Golootlo Discounts | ❌ | ✅ |

Please note that once you order one of these cards, you cannot switch to the other.

If your card is captured by an ATM:

- Visit the Branch: Go to the specific ATM branch and speak with the manager. The bank typically holds cards for 2 days. Bring your CNIC for identity verification.

- Contact Us: If the bank cannot return your card due to verification issues, call our helpline at 042-111-344-488 and provide the bank’s name. We will reach out to resolve the issue.

- Return of Card: If the ATM-captured cards are sent back to us, we will promptly return them to the respective users.

If you’re having trouble using your card for a physical purchase:

- Check if the Card is Frozen: Unfreeze your card via the app if needed.

- Verify the PIN: Ensure you’re entering the correct PIN. You can reset it from the app under “Card Controls.”

- Check Your Balance: Confirm that you have sufficient funds in your wallet.

If the issue persists, contact us via our helpline or WhatsApp support at 042-111-344-488. Provide the following details:

- The amount of the transaction.

- The location where you tried to use your card.

- Whether you tried to pay by inserting or tapping the card.

- A screenshot of the error message displayed.

If the courier status shows your card was delivered and signed for, but you haven’t received it:

- Check with Family/Neighbours: Confirm if someone accepted it on your behalf.

- Contact Support: If the card was delivered to the wrong address, contact us via WhatsApp or our helpline at 042-111-344-488, and we’ll investigate and resolve the issue.

If your address is outside our courier’s service range:

- Provide an Alternate Address: Contact us via WhatsApp or our helpline at 042-111-344-488 with a complete and accurate alternate address where you can receive the card.